Corporate Governance

Basic Approach to Corporate Governance

MJS's main business is to provide business management systems and management expertise services. We recognize developing and building management systems and internal control systems and implementing necessary measures as the essential basis for corporate governance initiatives, and regard corporate governance as one of the most important management issues.

Going forward, we will continue to enhance the governance of both MJS and its subsidiaries, and strive to increase the corporate value of the Group as a whole.

Corporate Governance System

(1) Overview of the current system

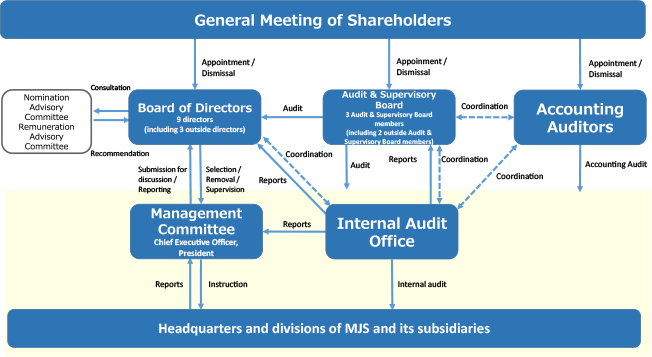

MJS is a company with Audit & Supervisory Board members, and has instituted a General Meeting of Shareholders, Board of Directors, Audit & Supervisory Board members, Audit & Supervisory Board, and Accounting Auditors as stipulated by the Companies Act. We also maintain the Group's corporate governance system and strengthen its functionality under the system shown in the diagram below.

(2) State of business management organization

The Company's decision-making bodies are the Board of Directors and the Management Committee. The Board of Directors meets once or twice a month on a regular basis to deliberate and decide upon matters stipulated under laws, regulations and the Articles of Incorporation, and important management matters as provided for under the Board of Directors Regulations. Seventeen regular meetings of the Board of Directors were held during the last fiscal year. The Management Committee is hosted by the President and CEO, and is composed of full-time directors and other persons nominated by the President. Meetings are held twice a month in principle. The Management Committee exists as an important decision-making body for the purpose of prior deliberations on policies regarding prompt management decisions, business operations and management, and matters to be discussed by the Board of Directors. Twenty-five regular meetings of the Management Committee were held during the last fiscal year.

The Company also appoints outside directors and outside Audit & Supervisory Board members for the Board of Directors to receive advice and guidance as appropriate, with the aim of further enhancing supervisory functions. All outside directors and outside Audit & Supervisory Board members are appointed as independent officers to make decisions that take into account the interests of general shareholders by making recommendations for management from an objective and neutral perspective, as part of our efforts to further enhance corporate governance.

(3) Status of committees

(i) Nomination Advisory Committee and Remuneration Advisory Committee

The Company has established the Nomination Advisory Committee and the Remuneration Advisory Committee as advisory bodies to the Board of Directors in order to further enhance the corporate governance system by strengthening the independence, objectivity and accountability of the Board of Directors' functions related to director nomination and remuneration.

In principle, each committee meets once a year in response to a consultation from the Board of Directors to discuss and report to the Board of Directors on the following matters.

- - Policy on appointment and dismissal of directors (matters to be resolved at the General Meeting of Shareholders)

- - Matters regarding the selection and dismissal of representative directors

- - Matters regarding the selection and dismissal of directors with specific titles

- - Policy on determination of remuneration, etc. of individual directors

- - The establishment, modification, or repeal of rules, procedures, etc. necessary for the resolution of the preceding items.

- - Other matters deemed necessary for deliberation by each committee

The Board of Directors stipulates in each committee's rules that the Board of Directors shall make decisions respecting the content of each committee's report.

Each committee consists of seven members: two internal directors, four independent outside directors and one independent outside Audit & Supervisory Board member, with a majority of the members being independent outside directors, to be determined at a meeting of the Board of Directors to be held after the Annual General Meeting of Shareholders.

The composition of the Nomination Advisory Committee and the Remuneration Advisory Committee is as follows.

Nomination Advisory Committee

In addition to Hiroki Koreeda, President and Representative Director, who is the chair of the committee, the committee consists of Masanori Suzuki, Vice Chairman of the Board, Hirofumi Gomi, Independent Outside Director, Takao Kitabata, Independent Outside Director, Takuma Ishiyama, Independent Outside Director, Aki Yamauchi, Independent Outside Director , and Keiichi Tadaki, Independent Outside Audit & Supervisory Board Member. In response to a consultation from the Board of Directors, the Nomination Advisory Committee reports to the Board of Directors on policies regarding the appointment and dismissal of directors, the appointment of directors for the next term, the selection of representative directors and directors with specific titles, and the skill matrix proposal.

Remuneration Advisory Committee

In addition to Hiroki Koreeda, President and Representative Director, who is the chair of the committee, the committee consists of Masanori Suzuki, Vice Chairman of the Board, Hirofumi Gomi, Independent Outside Director, Takao Kitabata, Independent Outside Director, Takuma Ishiyama, Independent Outside Director, Aki Yamauchi, Independent Outside Director, and Hiroshi Nakahara, Independent Outside Audit & Supervisory Board Member. In response to a consultation from the Board of Directors, the Remuneration Advisory Committee reports to the Board of Directors on the Company's policy for determining the content of individual director remuneration and other matters.

(ii) Compliance Committee

The Company has established a Compliance Committee to promote the Group's compliance system. The Compliance Committee meets twice a year in principle to deliberate on matters related to policies, measures, education, and other matters concerning the promotion of compliance, and reports the results of its deliberations to the Board of Directors. In addition, in place of the Board of Directors, it provides advice and recommendations at Risk Management Committee meetings, or to divisions in charge of risks.

The committee consists of 13 members: four internal directors, one full-time Audit & Supervisory Board member, one independent outside director, two independent outside Audit & Supervisory Board members, and five executive officers, to be determined at a meeting of the Board of Directors to be held after the Annual General Meeting of Shareholders.

In addition to Masanori Suzuki, Vice Chairman of the Board (in charge of compliance promotion), who is the chair of the committee, the committee consists of Tetsushi Ishikawa, Director and Managing Executive Officer, Eiichi Takada, Director and Managing Executive Officer, Junichi Sato, Director and Managing Executive Officer, Hiroshi Makino, Full-time Audit & Supervisory Board Member, Aki Yamauchi, Independent Outside Director, Keiichi Tadaki, Independent Outside Audit & Supervisory Board Member, and Hiroshi Nakahara, Independent Outside Audit & Supervisory Board Member, as well as a wide range of executive officers selected from a wide range of divisions including sales, development and support, business administration, and divisions under the direct control of the President and CEO.

(iii) Risk Management Committee

The Risk Management Committee was established in August 2024, to further enhance the Group's risk management system. The Group classifies management risks into four categories: strategic risks, financial risks, hazard risks, and operational risks. Strategic risks are primarily managed and discussed by the Management Committee, while risks other than strategic risk are managed and discussed by the Risk Management Committee.

In principle, the Risk Management Committee meets on a quarterly basis to hold discussions with a focus on important issues such as identification, prioritization, and response policies for risks in the Group, and to regularly monitor the status of risk management through the Internal Control Division in an effort to improve the quality of risk management. The proceedings of the Risk Management Committee are reported to the Management Committee and the Board of Directors on a quarterly basis.

The committee also discusses the identification of important risks at subsidiaries and their response policies, as well as risk management support measures from the Company to subsidiaries, and promptly shares the Group-wide risk management policy with the senior management of subsidiaries. The Company also strives to ensure the consistency and effectiveness of risk management throughout the Group by regularly monitoring the state of risk management at subsidiaries through the Affiliate Companies Management Division.

In addition to Hiroki Koreeda, President and Representative Director, who is the chair of the committee, the committee consists of Nobuhiko Koreeda, Chairman of the Board, Masanori Suzuki, Vice Chairman of the Board, Tetsushi Ishikawa, Director and Managing Executive Officer, Eiichi Takada, Director and Managing Executive Officer, Junichi Sato, Director and Managing Executive Officer, Toshiharu Okubo, Director, Keishi Terasawa, Director, Hiroshi Makino, Full-time Audit & Supervisory Board Member, and the General Manager of the President's Office.

(iv) Sustainability Committee

The Company has established a Sustainability Committee for the purpose of promoting sustainability management. The Sustainability Committee meets twice a year in principle to set and review sustainability policies and materiality, set KPIs and manage progress, evaluate the results of activities, and discuss targets and initiatives for the next fiscal year based on the evaluation.

Policies and issues reviewed and discussed by the Sustainability Committee are submitted or reported to the Management Committee and the Board of Directors, which regularly oversees this process and directs actions as necessary.

In addition to Hiroki Koreeda, President and Representative Director, who is the chair of the committee, and Masanori Suzuki, Vice Chairman of the Board, who is the vice chair of the committee, the committee consists of executive officers in charge of related divisions and department heads.

(4) Policies and procedures for nominating candidate directors and Audit & Supervisory Board members and determining remuneration for senior management and directors

When nominating candidates for director positions, the Company selects persons who are familiar with the Company's business, have extensive networks and a wide range of knowledge both inside and outside the industry, and can make appropriate decisions and management judgments. Candidate nominations are validated and finalized by the Board of Directors after initial deliberations by the Nomination Advisory Committee. In addition to the criteria for determining the independence of independent directors as set forth by the Tokyo Stock Exchange, the criteria for determining the independence of outside directors include the following: the director must be able to offer opinions, advice, and criticism from a fair and impartial standpoint outside the company, unrestricted by the company's internal chain of command or practices, and must have an opinion from a broad perspective, broad insight, a sensitivity to market opinions, and a wealth of knowledge and experience in his or her field of expertise. The Nomination Advisory Committee deliberates on the nominees, and the Board of Directors verifies and decides on their qualifications. In principle, independent outside directors include persons with management experience at other companies.

When nominating candidates for Audit & Supervisory Board members, the Company selects persons who excel in financial, accounting and legal knowledge, risk management skills, and management oversight capabilities. Nominations are validated and finalized by the Board of Directors after obtaining the consent of the Audit & Supervisory Board. When nominating candidates for outside Audit & Supervisory Board members, in addition to the aforementioned abilities, the Company chooses candidates equipped with wide-ranging opinions, broad insights, and abundant knowledge and experience in the field from which they originate. Again, nominations are validated and finalized by the Board of Directors after obtaining the consent of the Audit & Supervisory Board.

In determining remuneration for senior management and directors, the Board of Directors determines a policy for deciding the details of remuneration, etc., for each individual director. Resolutions by the Board of Directors on remuneration are made based on reports by the Remuneration Advisory Committee, which is consulted in advance regarding the details of the resolution. Details of the policy for determining details of remuneration, etc., for individual directors are as follows.

(i) Basic policy

In order to secure diverse and excellent human resources and further improve corporate value, the Company's basic policy is to determine levels of remuneration for directors appropriate to individual roles and responsibilities with consideration for the levels of remuneration at listed companies as a whole and other companies in the same industry. Remuneration consists of fixed remuneration, performance-linked remuneration and non-monetary remuneration. Outside directors are paid only fixed remuneration, since they are responsible for monitoring and supervising management from an independent standpoint.

(ii) Policy for determining the amount of basic remuneration for individual directors

Basic remuneration for directors of the Company is a monthly fixed remuneration, determined comprehensively taking into consideration the position, experience, and duties of each director.

(iii) Policy for determining the details of performance-linked remuneration and non-monetary remuneration, and methods for calculating the amounts or numbers thereof

Performance-linked remuneration, etc., is granted with respect to results and performance, and linked to profits obtained from the entire business. Specifically, the Company's consolidated ordinary income is used as an indicator of performance-linked remuneration. Remuneration is determined taking into consideration performance for a single fiscal year and paid on a monthly pro-rated basis as monthly remuneration.

Non-monetary remuneration is basically remuneration in the form of restricted stock with the promise that the restrictions on transfer will be lifted upon retirement. The number of shares granted is determined based on comprehensive consideration of position, experience, duties in charge, ratio to monetary remuneration, and stock price, and is paid at a fixed time each year.

(iv) Policy for determining the ratio of the amounts of monetary remuneration, performance-linked remuneration, etc., and non-monetary remuneration for individual directors

The ratio of basic remuneration, performance-linked remuneration and non-monetary remuneration for directors shall be determined by taking into consideration their position, experience, responsibilities and performance.

(v) Matters concerning decisions on the details of remuneration paid to individual directors

The Remuneration Advisory Committee deliberates and determines policies for determining the amounts and other details of remuneration, etc., paid to individual directors regarding basic remuneration and performance-linked remuneration, and the Company leaves the decision to the President, the Chairman, and the Chief Financial Officer (CFO) with the approval of the Board of Directors, who discuss and decide details of remuneration, etc., based on the policies determined by the Committee.

The number of restricted shares to be granted to individual directors as non-monetary remuneration shall be determined by the Board of Directors.

(5) Roles and functions of outside directors

Outside directors of the Company are responsible for raising opinions from a fair position outside the company that is not bound by the company's chain of command and practices and providing advice and criticism from the standpoint of a third party in establishing a compliance system.

The main activities of outside directors in the previous fiscal year were as follows:

Hirofumi Gomi attended all 17 meetings of the Board of Directors held during the last fiscal year. He has a high level of knowledge and extensive experience in financial administration, management strategy and governance developed through his experiences in an important position at the Ministry of Finance, the Financial Services Agency, and as an outside officer at other companies, and actively expresses his opinions from these perspectives at meetings of the Board of Directors. He plays an appropriate role in ensuring the validity and appropriateness of decision making. As a member of the Nomination Advisory Committee and the Remuneration Advisory Committee, he attended the one and only meeting of the Nomination Advisory Committee and all two meetings of the Remuneration Advisory Committee during the last fiscal year, and fulfilled his supervisory function in the process of selecting the Company's director candidates and determining director remuneration, etc. from an objective and neutral standpoint.

Takao Kitabata attended 15 of the 17 meetings of the Board of Directors held during the last fiscal year. He held important positions at the Ministry of Economy, Trade and Industry and served as an outside officer at other companies, and has a high level of knowledge and extensive experience in new business development, human resources development, and governance developed through his experience as university president, and actively expresses his opinions from these perspectives at meetings of the Board of Directors. He plays an appropriate role in ensuring the validity and appropriateness of decision making. As a member of the Nomination Advisory Committee and the Remuneration Advisory Committee, he attended the one and only meeting of the Nomination Advisory Committee and all two meetings of the Remuneration Advisory Committee during the last fiscal year, and fulfilled his supervisory function in the process of selecting the Company's director candidates and determining director remuneration, etc. from an objective and neutral standpoint.

Takuma Ishiyama attended 15 of the 17 meetings of the Board of Directors held during the last fiscal year. He has advanced knowledge and extensive experience in the legal and accounting fields gained as an academician, lawyer, and university president, and actively expresses opinions from such perspectives at meetings of the Board of Directors. He plays an appropriate role to ensure the validity and appropriateness of decision making. As a member of the Nomination Advisory Committee and the Remuneration Advisory Committee, he attended the one and only meeting of the Nomination Advisory Committee and all two meetings of the Remuneration Advisory Committee during the last fiscal year, and fulfilled his supervisory function in the process of selecting the Company's director candidates and determining director remuneration, etc. from an objective and neutral standpoint.

Aki Yamauchi attended all 17 meetings of the Board of Directors held during the last fiscal year . She has a high level of knowledge and extensive experience in the accounting field cultivated as an academician, and actively expresses opinions from such perspectives at meetings of the Board of Directors. She plays an appropriate role to ensure the validity and appropriateness of decision making. As a member of the Nomination Advisory Committee, Remuneration Advisory Committee, and Compliance Committee, she attended one Nomination Advisory Committee meeting , two Remuneration Advisory Committee meetings, and three Compliance Committee meetings during the last fiscal year , and fulfilled her supervisory function in the process of selecting the Company's director candidates and determining director remuneration, etc. and in the compliance system from an objective and neutral standpoint.

(6) State of audits by Audit & Supervisory Board members

The Audit & Supervisory Board consists of three Audit & Supervisory Board members, including two outside board members, and holds meetings once a month in principle.

Audit & Supervisory Board members attend important meetings including meetings of the Board of Directors and the Management Committee, view important approval documents and audit directors' execution of duties, the decision making of the Board of Directors, status of the development of internal control systems and competing transactions, etc., based on the Audit & Supervisory Board Regulations, Audit & Supervisory Board Audit Standards, Audit Practice Standards for Internal Control Systems, etc.

Audit & Supervisory Board members receive reports from directors and accounting auditors on the status of their execution of duties as necessary, coordinating closely with the internal audit department and requesting explanations as necessary.

With regard to subsidiaries, the Audit & Supervisory Board members communicate and exchange information with directors and auditors of subsidiaries, and receive business reports as needed.

Hiroshi Makino is a full-time Audit & Supervisory Board member who has been involved in the operations of the Company's sales and management divisions for many years, and has served as the head of the Internal Audit Office. He has extensive experience and considerable knowledge of compliance and risk management issues. Outside Audit & Supervisory Board member Keiichi Tadaki has served as a public prosecutor, Vice-Minister of Justice, and Prosecutor General. He has extensive knowledge and insights in law and compliance, in his current capacity as an attorney. Outside Audit & Supervisory Board member Hiroshi Nakahara has held important positions including Commissioner of the National Tax Agency and representative director of a financial institution, and has extensive knowledge and management experience in taxation and finance.

(7) State of internal audits

The Internal Audit Office consists of six members, including the department manager, and was established as an organization under the direct control of the President, independent of other administrative and business divisions.

Based on MJS Group Internal Audit Regulations and the annual business audit plan, the Internal Audit Office conducts audits of the head office division, branches and subsidiaries with an emphasis on rationality and efficiency in overall business activities and the effectiveness of information management and risk management systems, and evaluates internal controls related to financial reporting. When internal control issues are discovered in accounting audits, the office cooperates with accounting auditors to monitor the state of improvements.

The Internal Audit Office regularly reports to the Board of Directors and the Audit & Supervisory Board and closely coordinates with directors, Audit & Supervisory Board members and accounting auditors to improve the effectiveness and efficiency of audits.

(8) State of accounting audits

The Company outsources its statutory accounting audits to BDO Sanyu & Co., an auditing corporation, and consults and obtains advice as necessary. The duration of the continuous audit period, names of certified public accountants who carried out the audit, and membership of the team of assistants aiding in auditing work are as follows.

| Continuous audit period | 37 years |

| Names of certified public accountants who carried out the audit | Affiliated auditing corporation |

|

Hiroshi Saito Nobuhiko Tamai |

BDO Sanyu & Co. As above |

| Composition of team of assistants aiding in audit operations |

Certified public accountants 5 |

Others 5 |

(9) State of initiatives to enhance auditing functions

The Company has nominated and submitted notices for two outside Audit & Supervisory Board members as independent officers. For the reasons for the appointment of such independent outside Audit & Supervisory Board members, please refer to "Audit & Supervisory Board Members" in "II. 1. Organizational Composition and Operation" of the report.

The main activities of outside Audit & Supervisory Board members in the previous fiscal year were as follows:

Keiichi Tadaki attended all 17 meetings of the Board of Directors and all 14 meetings of the Audit & Supervisory Board held during the last fiscal year. As a member of the Nomination Advisory Committee and the Compliance Committee, he attended the one and only meeting of the Nomination Advisory Committee and all three meetings of the Compliance Committee held during the last fiscal year, and made comments as appropriate on deliberations of proposals.

Hiroshi Nakahara attended all 13 meetings of the Board of Directors and all 10 meetings of the Audit & Supervisory Board held during the last fiscal year since his appointment. As a member of the Nomination Advisory Committee and the Compliance Committee, he attended the one and only meeting of the Nomination Advisory Committee and all two meetings of the Compliance Committee held during the last fiscal year since his appointment, and made comments as appropriate on deliberations of proposals.

(10) Limitation of liability of directors and Audit & Supervisory Board members

In accordance with Article 427 Paragraph 1 of the Companies Act, the Company has entered into agreements (called limited liability agreements) with its outside directors and outside Audit & Supervisory Board members to limit liability for damages when falling under the requirements stipulated by law with regard to liability for damages under Article 423 Paragraph 1 of the Act. The maximum amount of liability for damages under these agreements is the minimum liability limit stipulated by law.

Actions to implement management with awareness of cost of capital and the stock price

In order to achieve sustainable growth and increase corporate value, we are committed to managing our business with an awareness of cost of capital and return on equity.

(1) Analysis of current situation

The Company's return on equity (ROE) for the last fiscal year was 15.6%, and has remained high at 16.7% (highest 21.4%, lowest 13.6%) on average over the past five years, consistently exceeding the anticipated cost of capital. The PBR (Price to Book Ratio) based on the closing price of the Company's stock at the end of the last fiscal year was 1.9 times, and the Company will engage in management emphasizing return on capital to achieve further improvements.

(2) Major initiatives

(i) Disclosure of goals to enhance corporate value over the medium to long term

The Company has formulated and announced a medium-term management plan for sustainable growth and enhancement of corporate value. As stated in the plan, we will promote the shift to a subscription-based revenue model in our ERP business to achieve a more stable revenue structure and high profitability. In terms of management targets for FY2028, we aim to maintain efficiency that exceeds the cost of capital and to achieve further business growth and capital profitability over the medium to long term, with an ordinary income to net sales ratio of 20% and ROE of 18%.

(ii) Reduction of cost of capital by expanding disclosure of non-financial information

In addition to our efforts to improve return on capital, we are expanding the disclosure of non-financial information, such as climate-related financial information based on the TCFD recommendations, and sustainability management initiatives, including the promotion of human capital management, to help shareholders and investors understand our company and reduce the cost of capital.

(iii) Design of an officer remuneration system that provides incentives to improve corporate value over the medium to long term

The Company has introduced a restricted stock compensation plan for officers to raise management awareness of future corporate value and encourage management with a view to long-term growth from the perspective of shareholders and investors.

(iv) Long-term stable shareholder returns

The Company has adopted a basic policy of ensuring stable dividends over the long term, comprehensively taking into consideration financial results, the strengthening of its financial position, business development in the future, and other factors, in order to realize sustainable growth and increase corporate value. Based on this, we aim to return profits to shareholders both directly and through medium- and long-term share price increases, and pay stable dividends through profit growth, aiming for a dividend payout ratio of 30% to 40%. The dividend for the last fiscal year is expected to be 55 yen (payout ratio 37.6%), an increase of five yen from the previous two fiscal years.

In addition, the Company will purchase treasury stock as necessary in order to execute a flexible capital policy in response to changes in the business environment, and to improve capital efficiency.

For more information on corporate governance, please refer to our Corporate Governance Report.