The MJS Group’s Basic Growth Strategies

1.The Positioning of Sustainability 2030 and the Medium-Term Management Plan Vision 2028

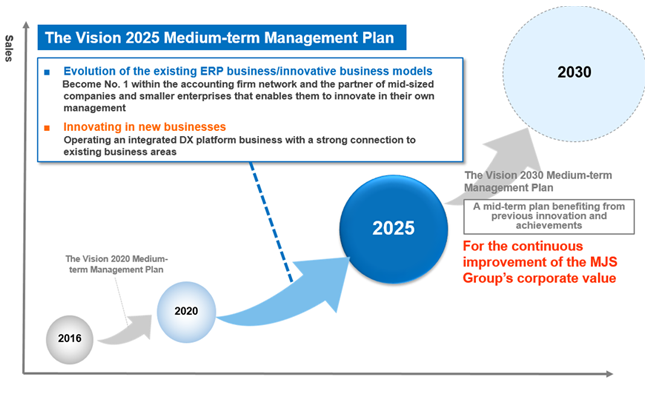

The current Medium-Term Management Plan Vision 2025 was updated, and Sustainability 2030 and the Medium-Term Management Plan Vision 2028 were formulated to move to the next stage.

2.MJS's Corporate Philosophy and Vision System

3.Sustainability 2030 Vision

4.Human Capital Management Indicators and Targets

Seek to create an attractive company, organizational culture, and workplace environment by developing a medium- to long-term personnel strategy and human resources vision for achieving the Corporate Philosophy, Sustainability 2030, and the Medium-Term Management Plan Vision 2028.

| FY2023 Results | FY2025 Results | FY2030 Results | |

|---|---|---|---|

| Ratio of women in management | 12% | 14% | 21%※ |

| Ratio of female hires | 42% | 45% | 50% |

| Ratio of male employees taking childcare leave | 36% | 55% | 85% |

| Engagement score | 3.5P | 3.7P | 4.5P |

| Wage gap between men and women | 81% | 82% | 87% |

Updated June 27, 2024

- Personnel measures will be continued, with an aim to keep the percentage of women in management at 30% from FY2031 onward.

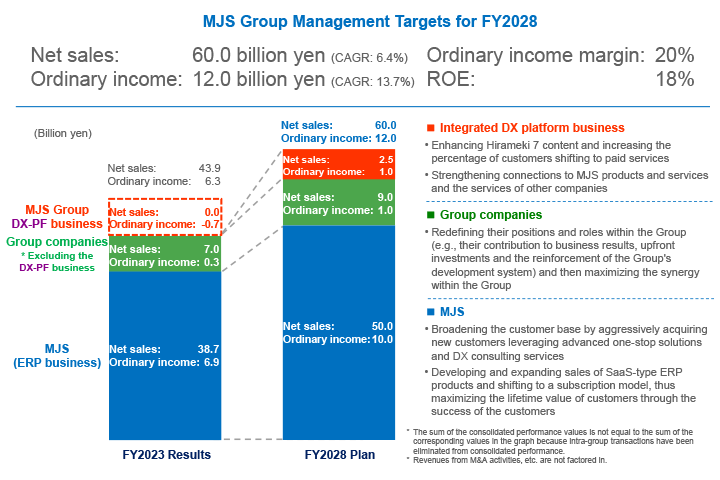

5.Management Targets in the Medium-Term Management Plan Vision 2028

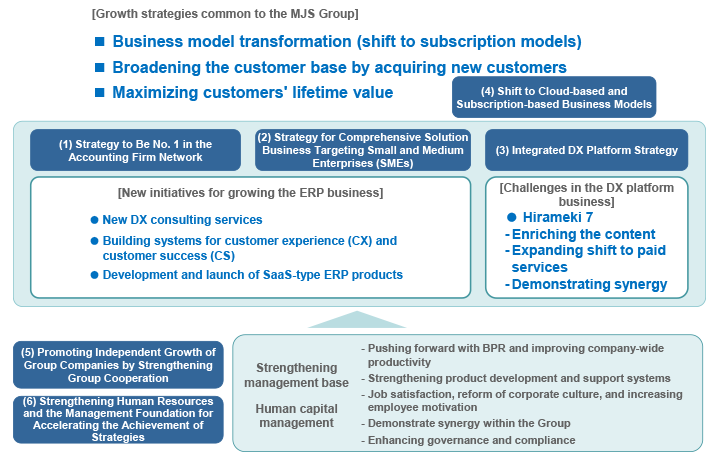

6.The MJS Group’s Basic Growth Strategies

-

Strategy to Be No. 1 in Accounting Firm Network

Through functional enhancement of ERP products and new SaaS business, MJS will achieve thorough operational efficiency and enhancement of management support service capabilities at accounting firms. In addition, together with accounting firms, MJS will develop new DX consulting services that will be right beside the needs of client companies, helping them improve their management and strengthen their competitiveness through DX. -

Strategy for Comprehensive Solution Business Targeting Small and Medium Enterprises (SMEs)

MJS will develop and provide SaaS-based ERP systems that support business improvement and growth for small and medium enterprises (SMEs). In addition, MJS will be expanding business by strengthening its comprehensive system integration (SI) services structure. Moreover, by leveraging the synergies of the MJS Group, MJS will develop DX consulting services that solve a wider range of management issues for customers.

-

Integrated DX Platform Strategy

By evolving the integrated DX platform "Hirameki 7" operated by Tribeck Corporation, an MJS group company, MJS will strengthen the sales and marketing capabilities of small enterprises and microenterprises, as well as improve their productivity and business achievements through DX. MJS will also work with Tribeck on products and sales collaboration to create group synergies. -

Shift to Cloud-based and Subscription-based Business Models

MJS will promote shifting to cloud computing and subscription-based solutions for its core ERP products, maximizing customer benefits, building continuous relationships, and increasing customer lifetime value (LTV). To this end, MJS will build a customer success organization that leveraging bases across Japan, and provide optimal services that meet each individual customer needs. -

Promoting Independent Growth of Group Companies by Strengthening Group Cooperation

MJS will clarify the positioning of each company in line with the MJS Group's growth strategies, and execute to reorganize and strengthen the group, prioritizing the demonstration of group synergies and improved profitability. Furthermore, MJS will execute strategies with considering M&A growth, aiming for further growth of the MJS Group. -

Strengthening Human Resources and the Management Foundation for Accelerating the Achievement of Strategies

MJS will accelerate business growth by investing in human resources that promote diversity and flexible work styles while maximizing human and organizational strength. MJS will also promote management visualization and operational efficiency through the renewal of the internal information system. Moreover, MJS will improve the transparency of decision-making in corporate governance,and strengthen risk management for the entire Group.

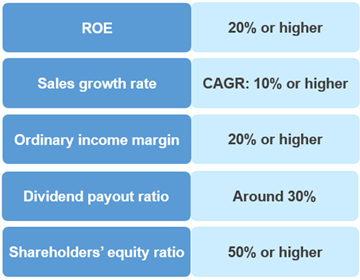

7.Quantitative Targets in Management Indicators

- We aim to achieve the FY2028 ROE target of higher than 18% by improving profitability through further growth of the ERP business and enhancing capital efficiency through agile share buybacks. In addition, we will enhance shareholder returns further by increasing dividends in response to profit growth.

- We will enhance disclosure of non-financial information to gain understanding of our company from shareholders and investors, thus reducing capital cost.

【FY2028 Targets】

| Return on equity(ROE) | Over 18% |

|---|---|

| Dividend payout ratio | 30%~40% |

| Shareholders' equity | Over 40.0 billion yen |